The Future is Virtual: Business Credit Card Options

Discover the benefits of Virtual business credit cards for security, efficiency, and control. Learn how to integrate them into your business.

Virtual business credit cards are revolutionizing the way small businesses manage their finances. These digital cards offer a secure and flexible alternative to traditional payment methods. If you’re looking to improve your business’s financial security and streamline transactions, virtual cards might be your next step. Here’s why:

- Digital Security: Generate unique numbers for each transaction, reducing fraud risks.

- Flexibility in Use: Perfect for online transactions without physical constraints.

- Expense Control: Set specific limits for each card, keeping budgets in check.

In today’s digital world, traditional payment methods sometimes fall short when it comes to security and efficiency. Virtual business credit cards provide that next level of protection and efficiency. They ensure that small business owners can focus more on growth and less on the hassle of financial management.

BCC Supplies is your trusted partner in navigating virtual business credit cards. Our expertise in offering cutting-edge solutions and tools empowers businesses to accept the future of digital transactions with confidence.

Understanding Virtual Business Credit Cards

Virtual business credit cards are a digital evolution of the traditional credit card, designed to meet the modern needs of businesses. These cards exist solely in a digital format, making them tailor-made for online and remote transactions. Let’s break down what makes them a game-changer:

Digital Format

Virtual cards are not tangible items you can hold in your hand. Instead, they are digital representations of a credit card, complete with a unique card number, expiration date, and security code. This digital nature allows for easy integration into various financial management systems, enabling businesses to manage transactions seamlessly.

Security Features

One of the standout features of virtual business credit cards is their robust security. Each card generates a unique number for every transaction, which significantly reduces the risk of fraud. This means your actual account number is never exposed, adding an extra layer of protection against data breaches.

- Single-Use Numbers: These numbers are used once and then discarded, making it virtually impossible for unauthorized users to make repeat transactions.

- Customizable Spending Limits: Businesses can set specific limits on virtual cards, ensuring that spending stays within budget and unauthorized purchases are minimized.

Why Choose Virtual Cards?

Virtual business credit cards are not just about security; they’re about giving businesses greater control and flexibility. They allow companies to streamline their financial processes, reduce the reliance on paper checks, and automate accounts payable. This leads to improved cash flow management and improved financial oversight.

BCC Supplies offers virtual business credit cards that integrate seamlessly with your existing systems, providing the tools you need to manage your business finances efficiently. As businesses continue to accept digital change, virtual cards stand out as a vital component in modern financial management.

Benefits of Virtual Business Credit Cards

Virtual business credit cards offer a wealth of advantages that can transform how businesses manage their finances. Here’s a closer look at the key benefits:

Security

Virtual cards are built with security at their core. Each transaction generates a unique card number, drastically reducing the risk of fraud and unauthorized access. This means your main account details remain safe, even if a breach occurs.

- Single-Use Numbers: Once a transaction is complete, the card number becomes invalid, making repeat fraud attempts impossible.

Efficiency

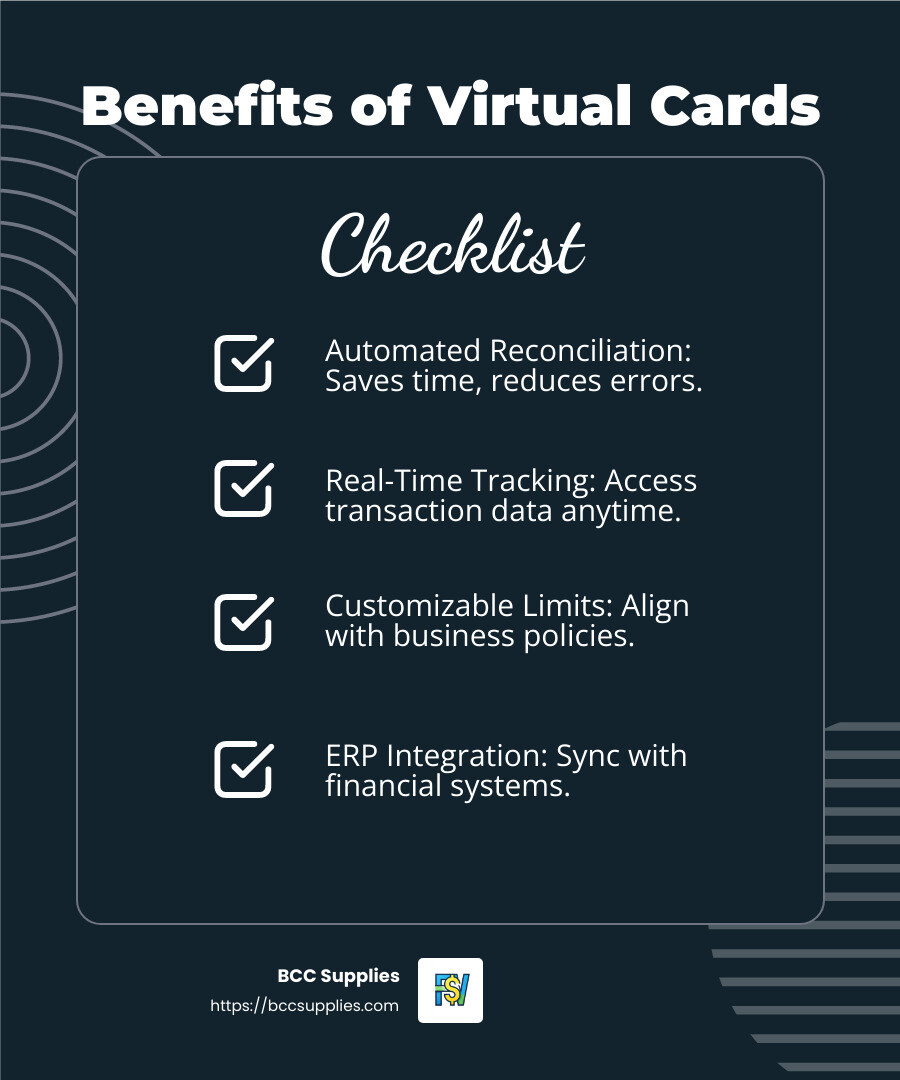

By eliminating the need for physical cards, businesses can streamline their payment processes. Virtual cards facilitate faster vendor payments and reduce the time spent on manual reconciliation.

- Automated Reconciliation: Transactions are automatically recorded, saving time and reducing errors.

Transparency

With virtual business credit cards, every transaction is tracked in real-time. This offers businesses a clear view of their spending patterns, making it easier to identify areas for cost savings.

- Real-Time Tracking: Access up-to-date transaction data anytime, anywhere.

Control

Virtual cards provide businesses with unparalleled control over their spending. Companies can set specific spending limits and expiration dates, ensuring that expenses remain within budget.

- Customizable Limits: Tailor spending restrictions to align with business policies and project timelines.

Integration

Seamless integration with existing financial systems is a hallmark of virtual business credit cards. This compatibility simplifies financial management and aligns with digital change goals.

- ERP Integration: Easily sync card transactions with enterprise resource planning (ERP) systems for cohesive financial oversight.

Tracking

The ability to track expenses in real-time leads to better financial planning and decision-making. Businesses can quickly analyze spending trends and adjust budgets as needed.

- Detailed Reporting: Generate comprehensive reports to gain insights into spending behaviors and optimize resource allocation.

Virtual business credit cards are more than just a payment tool—they’re a strategic asset that improves security, efficiency, and control. As your business grows, these cards will help streamline financial operations and support sustainable expansion.

In the next section, we’ll explore how to effectively use virtual business credit cards to maximize these benefits.

How to Use Virtual Business Credit Cards

Virtual business credit cards can revolutionize the way your company handles expenses. Let’s explore how you can make the most of these digital tools.

Employee Accounts

Virtual cards simplify employee spending. Each team member can have their own card, with limits set according to their role and responsibilities. This ensures spending aligns with company budgets and policies.

- Custom Access: Assign cards to employees based on their specific needs and set clear spending rules.

- Easy Management: Create and deactivate cards instantly as team members join or leave the company.

Transaction Management

Managing transactions is a breeze with virtual cards. Every purchase is logged automatically, providing a clear record of all expenses.

- Automatic Logging: Each transaction is captured in real-time, reducing the need for manual entry.

- Expense Categorization: Use software to categorize expenses, making it easier to track spending patterns and identify cost-saving opportunities.

Mobile and Desktop Access

Virtual business credit cards offer flexibility, allowing you to manage expenses from any device. Whether you’re at your desk or on the go, you can keep tabs on your spending.

- Mobile-Friendly: Use your phone to monitor transactions, approve expenses, and adjust spending limits.

- Desktop Control: Access detailed reports and manage employee accounts from your computer for comprehensive oversight.

With these tools, virtual business credit cards empower your team to make purchases confidently while maintaining tight control over company finances.

In the next section, we’ll dive into the top features of virtual business credit cards that make them an essential part of modern financial management.

Top Features of Virtual Business Credit Cards

Virtual business credit cards come packed with features that make them a game-changer for businesses. Let’s explore some of the most impactful ones.

Single-Use Numbers

One of the standout features of virtual business credit cards is the ability to generate single-use numbers. These are perfect for secure transactions because they reduce the risk of fraud.

- Improved Security: Single-use numbers ensure that your main account details remain hidden, which protects against unauthorized charges.

- Specific Transactions: Each number is tied to a specific purchase, providing an extra layer of security and peace of mind.

Spending Limits

Virtual cards allow you to set strict spending limits, ensuring that your team stays within budget.

- Controlled Expenses: Assign precise limits to each card, avoiding overspending and keeping your financial plan on track.

- Budget Management: Easily adjust limits as needed, providing flexibility while maintaining control over company finances.

Seamless Integration

Integration with existing systems is crucial for smooth operations. Virtual cards offer seamless integration with various accounting and expense management software.

- Automated Syncing: Transactions are automatically synced with your accounting software, reducing the need for manual data entry.

- Unified Systems: Centralize expense management, making it easier to track and report financial data.

Flexibility

Virtual business credit cards provide unparalleled flexibility, adapting to the unique needs of your business.

- Custom Expiry Dates: Set custom expiration dates for each card, catering to specific project timelines or vendor agreements.

- Unlimited Issuance: As your team grows, issue unlimited cards without the hassle of physical distribution.

These features make virtual business credit cards an indispensable tool for modern businesses, offering security, control, and adaptability.

Next, we’ll address some frequently asked questions about virtual business credit cards to help you better understand their potential.

Frequently Asked Questions about Virtual Business Credit Cards

What is a virtual business credit card?

A virtual business credit card is a digital payment method that offers a secure and efficient way for businesses to manage their finances. Unlike physical cards, these exist only in a digital format and are issued by financial institutions. They come with unique card numbers, expiration dates, and security codes, just like traditional cards. These cards are designed to improve security and control, allowing businesses to manage transactions with stronger controls and reduced risk of fraud.

Can you get a virtual business credit card?

Yes, you can obtain a virtual business credit card through various financial institutions. Many banks and credit card companies now offer virtual cards as part of their services to cater to the growing need for secure online transactions. To get one, businesses typically need to apply through their bank or credit card provider, who will guide them through the setup process. Once approved, businesses can generate virtual card numbers as needed for specific transactions, ensuring flexibility and security.

Is it legal to use virtual business credit cards?

Absolutely, using virtual business credit cards is legal and compliant with financial regulations. These cards are issued by legitimate financial institutions and are subject to the same regulatory standards as traditional credit cards. They are designed to offer businesses a more secure method of handling transactions while complying with all necessary legal requirements. As with any financial tool, it’s important for businesses to ensure they are using these cards in accordance with their institution’s terms and conditions.

Virtual business credit cards are an innovative solution for modern financial management, offering improved security, control, and flexibility. As businesses continue to evolve, these digital tools provide a reliable way to manage expenses and streamline operations.

Next, we’ll explore how BCC Supplies can support your business growth with their range of innovative financial solutions.

Conclusion

At BCC Supplies, we’re committed to empowering your business with the tools and resources needed for growth. Our virtual business credit cards are designed to streamline your financial operations, offering improved security and control over your transactions. By integrating these digital solutions, you can manage your expenses more efficiently and focus on what truly matters—growing your business.

Our platform not only provides competitive prices on essential supplies but also leverages advanced AI tools to boost productivity. This unique combination helps you stay ahead in a competitive market. We aim to offer a seamless experience that supports your business in every way possible.

Explore how our virtual and physical card solutions can revolutionize your financial management. Learn more about our virtual and physical card issuing services and take the next step towards smarter business management with BCC Supplies.

Together, let’s build a future where your business can thrive with innovation and efficiency.