The Great Divide: Choosing Between Secured and Unsecured Business Credit Cards

Discover how to choose between Secure And Unsecure Business Credit Cards to boost credit and grow your business effectively.

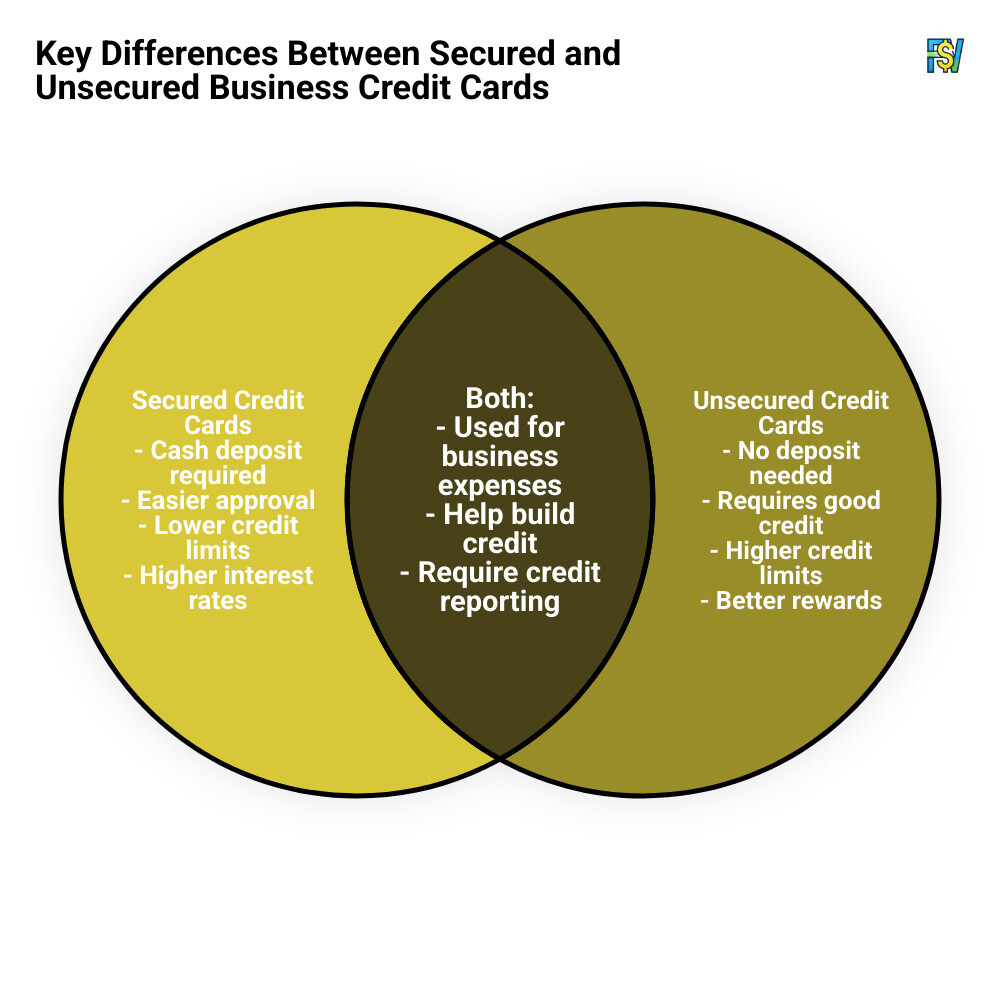

Secure And Unsecure Business Credit Cards are fundamental tools for businesses looking to separate personal expenses from company expenditures, build a strong credit profile, and gain access to financial flexibility. Here’s a quick breakdown to help you decide:

Secured Credit Cards:

- Require a cash deposit

- Easier approval with bad or no credit

- Lower credit limits

- Higher interest rates

Unsecured Credit Cards:

- No deposit needed

- Require good credit for approval

- Higher credit limits

- Often lower interest rates and better rewards

Choosing between secured and unsecured business credit cards hinges on credit history, credit needs, and financial goals.

At BCC Supplies, we specialize in helping businesses make informed financial decisions. With our wide range of wholesale products and advanced cloud-based AI tools, we assist in enhancing business productivity. Our deep understanding of Secure And Unsecure Business Credit Cards has been honed through our experience in the field, ensuring you find the right fit for your needs.

Must-know Secure And Unsecure Business Credit Cards terms:

- business credit card application process

- business credit card cash advance

- business credit cards for startups

Understanding Secured Business Credit Cards

When you’re just starting out or trying to rebuild your business credit, secured business credit cards can be a vital stepping stone. Let’s break down why they might be the right choice for your business.

Benefits of Secured Cards

Easy Approval: One of the biggest advantages of secured cards is the ease of approval. Since these cards require a security deposit, they pose less risk to issuers. This makes them accessible even if you have poor credit or no credit history at all.

Credit Building: Secured cards are designed to help build or rebuild your credit. As you use the card responsibly, your payment activity is reported to major business credit bureaus. Over time, this can improve your credit profile and open doors to more financing options.

Credit Limit: The credit limit on a secured card is typically equal to your security deposit. While this means a lower limit, it also encourages responsible spending, which is crucial for credit building.

Business Credit History: Establishing a solid business credit history is key to financial growth. A secured card helps separate personal and business expenses, making it easier to track and manage business finances.

Drawbacks of Secured Cards

Deposit Requirement: The need for a security deposit can be a hurdle. This upfront cash requirement can strain your budget, especially if funds are tight.

Limited Credit: With a secured card, your credit limit is usually restricted to the amount of your deposit. This can limit your purchasing power and may not be sufficient for larger business expenses.

Fewer Rewards: Compared to unsecured cards, secured cards often offer fewer rewards. While some cards might provide basic perks, they typically lack the extensive rewards programs that unsecured cards boast.

In summary, secured business credit cards are an excellent starting point for businesses aiming to build a solid credit foundation. They offer a pathway to better credit health, though they come with certain limitations. Understanding these factors will help you decide if a secured card aligns with your business needs.

Exploring Unsecured Business Credit Cards

Unsecured business credit cards can be a powerful tool for businesses that qualify. They offer flexibility and perks that can help manage finances more effectively.

Advantages of Unsecured Cards

No Deposit Required: Unlike secured cards, unsecured business credit cards do not require a security deposit. This means you can access credit without tying up your cash in a deposit, freeing up funds for other business needs.

Higher Credit Limits: Unsecured cards often come with higher credit limits than their secured counterparts. This can be particularly beneficial for businesses that need to make large purchases or manage fluctuating cash flows.

Better Rewards: Many unsecured business credit cards offer robust rewards programs. These might include cash back on purchases, travel rewards, or discounts on business expenses. Such perks can add significant value, especially if your business has substantial monthly expenses.

Disadvantages of Unsecured Cards

Credit Score Requirement: To qualify for an unsecured card, businesses typically need a good to excellent credit score. This can be a barrier for startups or businesses with a limited credit history.

Difficult Approval Process: The approval process for unsecured cards can be more stringent. Lenders assess your business’s creditworthiness, which might involve a detailed review of your financial history and credit score.

Higher Interest Rates: Unsecured business credit cards often have higher interest rates compared to secured cards. This means carrying a balance can quickly become costly if you’re not careful.

Unsecured business credit cards offer significant benefits, but they also come with challenges. If your business meets the credit requirements, these cards can provide valuable rewards and higher spending power. However, it’s crucial to weigh these advantages against the potential drawbacks, such as higher interest rates and stringent approval criteria.

Secure And Unsecure Business Credit Cards: Key Differences

When it comes to choosing between secured and unsecured business credit cards, understanding the key differences is crucial. Each type has its own benefits and challenges, and they can impact how quickly your business builds credit.

Secured vs. Unsecured: Which Builds Credit Faster?

Collateral and Credit Limits

Secured credit cards require a security deposit as collateral. This deposit often determines your credit limit, making it proportional to the amount you are willing to secure. In contrast, unsecured credit cards do not require a deposit, and their credit limits are determined by the creditworthiness of your business. While unsecured cards typically offer higher credit limits, they are harder to obtain, especially if your business has a limited credit history.

Credit Score and Credit Reporting

Building credit with a secured card can be more straightforward for businesses with limited or damaged credit. Since secured cards require collateral, they pose less risk for issuers, making them more accessible. Both secured and unsecured cards report payment activity to credit bureaus, which helps in building your business credit profile. However, secured cards are often used specifically to improve credit scores due to their accessibility.

Payment History and Credit Bureaus

Payment history is a critical factor in building credit. Consistently paying your credit card on time, whether it’s secured or unsecured, positively impacts your credit score. Secured cards are particularly beneficial for establishing a solid payment history due to their lower credit limits, which encourage responsible spending. This responsible use is reported to credit bureaus, helping improve your business’s credit profile over time.

In summary, while both secured and unsecured business credit cards can help build credit, secured cards may offer a faster path for businesses starting with little or no credit history. They provide a structured way to establish a payment history and demonstrate creditworthiness. On the other hand, if your business already has a strong credit profile, an unsecured card might offer better rewards and higher credit limits, accelerating credit growth.

Now, let’s dig into the application process for business credit cards, exploring what you need to know to increase your chances of approval.

Applying for Business Credit Cards

Tips for Approval

Applying for a business credit card can feel daunting, but understanding the process and preparing thoroughly can increase your chances of approval. Here’s a simple guide to help you steer the application process.

1. Gather Your Business Details

Start by collecting all necessary business information. This includes your business name, address, and industry type. You’ll also need your legal structure (like LLC or sole proprietorship), tax ID (EIN or SSN for sole proprietors), annual revenue, years in operation, and number of employees. Having these details ready will streamline your application process.

2. Prepare Personal Details

Even though you’re applying for a business credit card, your personal information is still important. Be ready to provide your name, contact details, Social Security number, ownership percentage, and your role within the company. This personal information helps issuers evaluate your creditworthiness.

3. Understand the Credit Check

Most credit card applications involve a credit check. This is where the issuer reviews your credit history to assess risk. A strong personal credit score can boost your chances of approval, especially for unsecured cards. If your credit score is less than ideal, consider a secured card as a stepping stone to improve it.

4. Know About Personal Guarantees

Many business credit cards require a personal guarantee. This means you agree to be personally responsible for the card’s debt if your business cannot pay. It’s crucial to understand this commitment, as it can affect your personal credit if payments are missed.

5. Financial Information is Key

Issuers will ask for details about your business’s financial health. Be prepared to provide estimated monthly spending and the intended use of the card. This information helps the issuer determine your credit limit and assess how you plan to manage the card.

6. Address Common Application Issues

Before applying, double-check all your information for accuracy. Mistakes like mismatched addresses or incorrect business names can lead to application delays or denials. If you’re a sole proprietor, be aware that this structure might raise red flags due to fraud risks.

7. Follow Up

After submitting your application, don’t just wait. A quick follow-up call or email can show issuers that you’re serious and proactive. If you don’t hear back within a week, politely inquire about your application status and offer any additional information if needed.

By preparing thoroughly and understanding the requirements, you can increase your chances of securing a business credit card that meets your needs.

Next, we’ll tackle some frequently asked questions about business credit cards, shedding light on common concerns and misconceptions.

Frequently Asked Questions about Business Credit Cards

What is the easiest unsecured business credit card to get?

When it comes to easy approval for an unsecured business credit card, some cards are designed for business owners with limited credit or no personal credit history. These cards often require no deposit, making them an attractive option for those just starting to build their business credit.

However, it’s important to note that while these cards may be easier to obtain than others, they still require some level of creditworthiness. Unlike secured cards, which require a security deposit, unsecured cards rely on your credit score and financial health for approval.

Can an LLC have a business credit card?

Yes, an LLC can certainly have a business credit card. In fact, having a business credit card is a smart move for LLCs. It helps in financial management by keeping personal and business expenses separate, which is crucial for accurate bookkeeping and tax purposes.

To apply, an LLC will typically need to provide its business details, such as the legal business name, address, and tax identification number (EIN). The creditworthiness of the business owner(s) is often considered during the approval process, so having a good personal credit score can be beneficial.

Do secured credit cards require collateral?

Yes, secured credit cards require a security deposit as collateral. This deposit generally determines your credit limit. For instance, if you deposit $500, your credit limit will likely be $500. This deposit reduces the risk for the issuer, making secured cards a viable option for those with poor or limited credit histories.

The approval process for secured cards is often more lenient compared to unsecured cards. They serve as a stepping stone for businesses looking to build or rebuild their credit. Over time, with consistent on-time payments, secured cards can help improve your credit score, potentially leading to the opportunity to upgrade to an unsecured card.

Conclusion

Navigating business credit cards is no small feat, but it’s a crucial step for any business aiming for growth. At BCC Supplies, we understand that choosing between secured and unsecured business credit cards can be daunting. Each type of card has its own set of benefits and drawbacks, and the right choice depends largely on your current financial situation and future goals.

For businesses just starting out or those with less-than-perfect credit, a secured business credit card offers a practical way to build or rebuild credit. These cards require a security deposit but provide a pathway to establish a solid credit history. Over time, this can lead to better financing options and greater financial flexibility.

On the other hand, unsecured business credit cards are ideal for those with a stronger credit profile. They often come with higher credit limits and more attractive rewards programs. However, they also require a good credit score for approval and may have higher interest rates.

At BCC Supplies, we encourage business owners to carefully consider their specific needs and financial standing when choosing a credit card. The right card can be a powerful tool for managing cash flow, separating personal and business expenses, and ultimately driving business growth.

As you make your decision, consider how each option aligns with your business objectives. Whether you’re looking to establish credit or leverage rewards for everyday expenses, the right choice can set the stage for your company’s success.

In conclusion, a thoughtful approach to selecting a business credit card can pave the way for financial health and growth. At BCC Supplies, we’re committed to supporting your journey with the tools and insights you need to make informed financial decisions.