How to Succeed at Opening a Net 30 Account, Even if You’ve Failed

Learn how to open a net 30 account to boost cash flow and build business credit with our step-by-step guide and expert tips.

How to open a net 30 account is a crucial step for many small businesses looking to improve cash flow and build business credit. Understanding how these accounts work can offer significant advantages. Here’s a quick overview to get started:

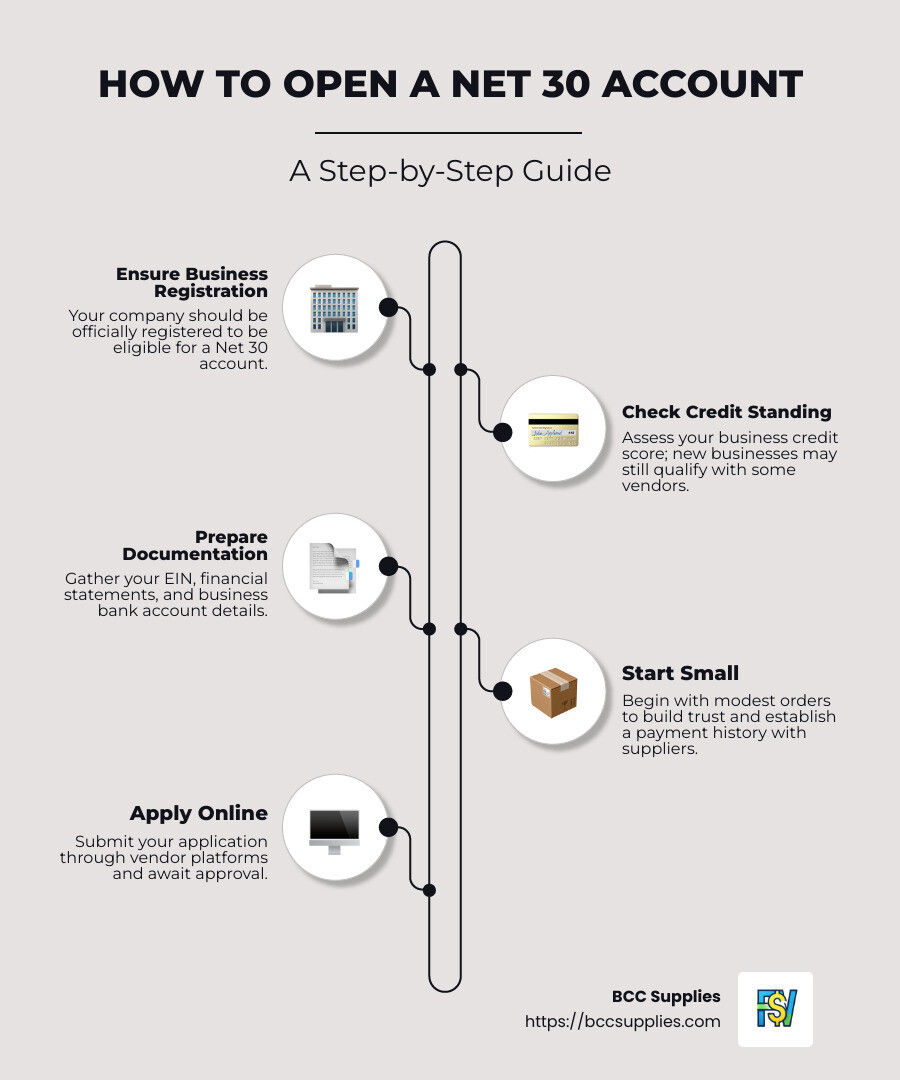

- Ensure Business Registration: Your company should be officially registered.

- Check Credit Standing: Good credit helps, but some vendors work with new businesses.

- Prepare Documentation: Have your EIN, financial statements, and business bank account details ready.

- Start Small: Begin with modest orders to build trust with suppliers.

Net 30 accounts offer a strategic way to manage your finances. With 30 days to settle invoices, they act as short-term loans, easing cash flow pressures.

At BCC Supplies, we understand the challenges and opportunities of net 30 accounts. As a leading wholesale provider, we’ve helped numerous businesses succeed with our advanced tools and flexible solutions. Stay tuned to find more about the benefits of net 30 accounts.

How to open a net 30 account terms to remember:

Understanding Net 30 Accounts

Net 30 accounts are a type of trade credit that businesses use to purchase goods or services and pay for them within 30 days. This arrangement is crucial for managing cash flow and building business credit.

Trade Credit

Trade credit is essentially a “buy now, pay later” agreement. It allows businesses to acquire necessary supplies without immediate payment. This can be a lifesaver, especially for startups and small businesses that might not have large cash reserves on hand. By deferring payment, companies can use the purchased goods to generate revenue before the invoice is due.

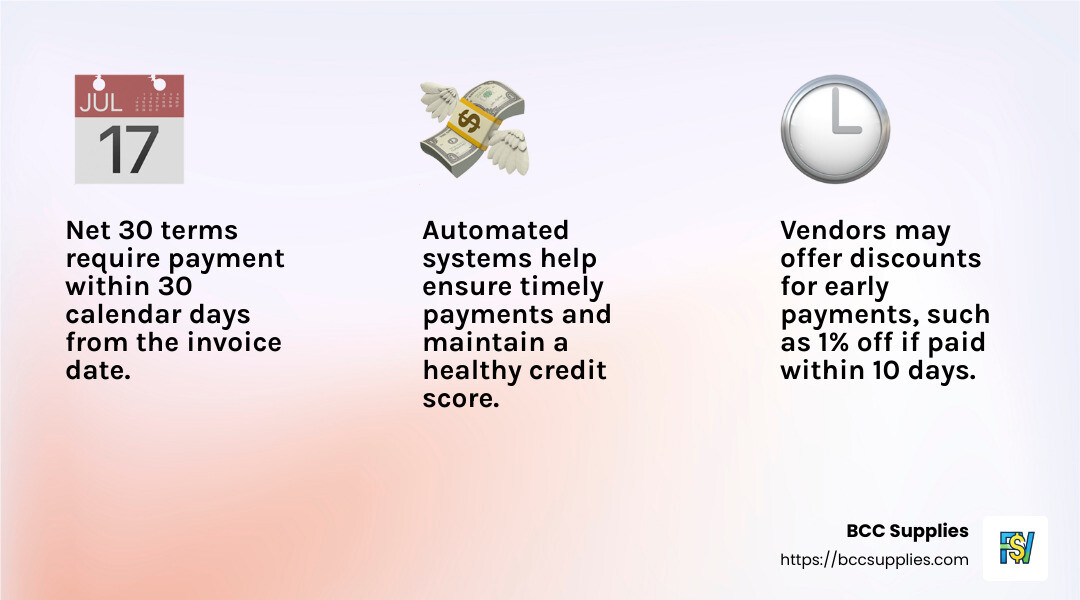

Payment Terms

Payment terms define the time frame within which a business must pay its invoice. With net 30 terms, the full payment is due 30 calendar days from the invoice date. This period includes weekends and holidays, so it’s crucial to keep track of exact dates to avoid late fees or interest charges. Some vendors even offer discounts for early payments, such as a 1% discount if paid within 10 days, known as 1%/10 net 30 terms.

Invoice Due Dates

Understanding invoice due dates is vital for maintaining a healthy business credit score. Late payments can negatively impact your credit rating and damage relationships with suppliers. Automated accounts payable systems can help businesses ensure timely payments, minimizing human error and freeing up time for other tasks.

Net 30 accounts, when managed well, can be a strategic asset for businesses. They not only improve cash flow but also help establish a positive credit history. Businesses that consistently pay on time may even negotiate for longer terms, such as net 45 or net 60, providing even more flexibility.

With a clear understanding of how net 30 accounts work, you’re well on your way to leveraging this tool for your business’s financial health.

How to Open a Net 30 Account

Opening a Net 30 account might seem daunting, but with the right preparation, it can be a straightforward process. Let’s break it down into two main steps: preparing your business and the application process.

Preparing Your Business for a Net 30 Account

Before you dive into applications, ensure your business is ready. Here’s what you’ll need:

Employer Identification Number (EIN): This is like a Social Security number for your business. It helps vendors verify your business identity.

Business Bank Account: Having a separate bank account for your business is crucial. It not only helps with bookkeeping but also demonstrates financial legitimacy to vendors.

Credit Reports: Vendors often check your business credit history. If you’re just starting, building a positive credit profile can be beneficial. You might need to provide credit reports from reputable credit agencies.

Steps to Apply for a Net 30 Account

Once your business is ready, follow these steps to apply for a Net 30 account:

Choose a Vendor: Select a vendor that aligns with your business needs. Each vendor might have slightly different requirements, so do your research.

Online Application: Most vendors offer an online application process. Look for the “Credit Application” section on their website.

Required Documentation: Gather all necessary documents before you start. This typically includes your EIN, business license, and possibly trade references.

Submit the Application: Fill out the application carefully, ensuring all information is accurate. Consistency in how you list your business name, address, and phone number is key.

Credit Assessment: After submission, the vendor will assess your creditworthiness. This may involve checking your business credit score and reviewing your financial stability.

Approval Process: The approval process can vary. Some vendors might approve your application quickly, while others may take longer. Be prepared to provide additional information if requested.

By following these steps, you’re setting your business up for success in securing a Net 30 account. This can lead to improved cash flow, better vendor relationships, and a stronger business credit profile.

Next, let’s explore the benefits of Net 30 accounts and how they can support your business growth.

Benefits of Net 30 Accounts

Net 30 accounts offer several compelling advantages for businesses looking to improve their financial health and operational efficiency. Let’s explore the key benefits: cash flow improvement, business credit building, and increased purchasing power.

Cash Flow Improvement

One of the most significant benefits of Net 30 accounts is the positive impact on cash flow management. With 30 days to pay your invoices, you can use available cash for other immediate needs. This means you can invest in growth opportunities, pay other bills, or handle unexpected expenses without worrying about running out of money.

Imagine a small retail store using a Net 30 account to stock up on inventory. They can start selling products before the invoice is due. The revenue from these sales can then be used to pay the supplier’s invoice, creating a smooth cash flow cycle. This flexibility can significantly boost your business operations.

Business Credit Building

Using Net 30 accounts also helps in building a robust business credit profile. Many vendors report payment histories to business credit bureaus. Paying your invoices on time can positively impact your business credit score.

A higher credit score can make it easier to secure loans, negotiate better terms with suppliers, and even attract more favorable insurance rates. In a way, Net 30 accounts act as a stepping stone in establishing your business’s creditworthiness.

Increased Purchasing Power

Net 30 accounts provide financial flexibility by giving you more time to pay for goods and services. This extended credit period can be crucial for managing seasonal fluctuations in revenue or unexpected expenses. For instance, a construction company might use a Net 30 account to purchase materials for a project. This allows them to complete the project, get paid by their client, and then pay the supplier.

Additionally, some suppliers offer early payment discounts as an incentive for paying invoices before the due date. For example, a 1%/10 Net 30 term means you get a 1% discount if you pay within 10 days. These discounts can add up over time and lead to significant savings, reducing overall expenses and improving profit margins.

In summary, Net 30 accounts offer multiple benefits, including better cash flow management, credit building, and potential cost savings through early payment discounts. These advantages make Net 30 accounts a valuable tool for any business looking to improve its financial health.

Next, let’s explore some top tips for successfully managing Net 30 accounts and maintaining healthy vendor relationships.

Top Tips for Successfully Managing Net 30 Accounts

Managing Net 30 accounts effectively is crucial for maintaining strong vendor relationships and a healthy business credit score. Here are some simple strategies to help you succeed:

On-Time Payments

Paying your invoices on time is the most critical aspect of managing Net 30 accounts. On-time payments not only improve your credit score but also build trust with your vendors.

Consider using an automated accounts payable system to ensure payments are never late. Automation reduces the risk of human error and can free up time for your team to focus on more strategic tasks. Plus, some vendors offer discounts for early payments, which can save money and improve your cash flow.

Building Strong Vendor Relationships

Good vendor relationships can lead to better terms and services. To build these relationships, communicate openly and regularly with your suppliers. If you foresee a delay in payment, inform your vendor as soon as possible.

Transparency can lead to flexible arrangements, like extended payment terms, and helps maintain mutual trust. Vendors are more likely to offer favorable terms to businesses they trust and have a strong relationship with.

Credit Score Impact

Your payment history with Net 30 accounts directly affects your business credit score. Vendors often report to business credit bureaus, so timely payments are crucial. A high credit score can open doors to better financing options and lower interest rates, giving your business a competitive edge.

Regularly monitor your credit reports to catch any errors or discrepancies early. Correcting mistakes promptly ensures your credit score accurately reflects your payment habits.

In summary, managing Net 30 accounts successfully involves making on-time payments, nurturing vendor relationships, and understanding the impact on your credit score. These practices will not only strengthen your business’s financial health but also pave the way for future growth and opportunities.

Next, let’s dive into some frequently asked questions about Net 30 accounts to clear up any lingering doubts.

Frequently Asked Questions about Net 30 Accounts

What are net 30 terms?

Net 30 terms are a type of credit arrangement between a business and its vendors. When you receive an invoice with net 30 terms, it means you have 30 days from the invoice date to make the full payment. This setup allows businesses to receive goods or services immediately but pay for them later, giving a short-term financial cushion.

Think of it as a mini loan from your vendor. You get the products you need to keep your business running, and the vendor trusts you to pay them back within a month. This arrangement helps manage cash flow, as you can use the goods to generate revenue before the payment is due.

How does using net 30 terms benefit my startup?

Using net 30 terms can be a game-changer for startups. Here’s why:

Improved Cash Flow: With net 30 terms, you don’t need to pay upfront for supplies. This means you can use your cash for other immediate needs, like rent or payroll, while still getting the inventory you need.

Building Credit History: Paying your net 30 invoices on time helps build a positive credit history. This is crucial for securing loans or better terms in the future. Vendors often report your payment history to business credit bureaus, which can boost your credit score over time.

Strengthened Vendor Relationships: Consistently paying on time builds trust with your vendors. This trust can lead to better terms, like discounts or extended payment periods, and a more collaborative business relationship.

Can late payments on net 30 terms affect my business credit score?

Absolutely. Late payments on net 30 terms can negatively impact your business credit score. Vendors typically report your payment history to major credit bureaus. If you consistently pay late, it can lower your credit score, making it harder to secure loans or favorable terms in the future.

To avoid this, set up reminders or automate payments to ensure you never miss a due date. Regularly check your credit reports for any discrepancies and address them promptly. Maintaining a good credit score can open doors to better financing options and business opportunities.

By understanding these aspects of net 30 accounts, you can use them effectively to support your business’s growth and financial health.

Conclusion

In wrapping up, it’s clear that net 30 accounts play a pivotal role in supporting business growth. They not only provide the much-needed flexibility in managing cash flow but also help in building a solid credit history. This credit foundation is essential for securing future financing opportunities and strengthening vendor relationships.

At BCC Supplies, we understand the challenges businesses face in today’s environment. That’s why we offer more than just competitive prices on business essentials. Our platform integrates advanced AI tools designed to boost productivity and streamline operations. These digital resources help businesses not only thrive but excel in their respective industries.

By choosing BCC Supplies, you’re not just getting access to wholesale prices and net 30 accounts. You’re also partnering with a company committed to your success, offering tools and resources that make managing your business easier and more efficient.

Ready to take the next step? Explore how our net 30 accounts can support your business growth today.