7 Things Every Business Owner Needs to Know About Net 30 Vendors

Learn the essentials of business credit net 30 vendors, from benefits to application tips, and boost your business's financial flexibility.

If you’re searching for business credit net 30 vendors, here’s what you need to know upfront:

- Net 30 Accounts: Allows you to purchase goods and pay the invoice within 30 days.

- Business Credit: Payments on net 30 accounts help build your business’s credit score.

- Cash Flow: Helps manage your cash flow by delaying payments.

Net 30 accounts, also known as trade credit, are essential tools for small business owners. These accounts allow you to purchase necessary supplies now and pay later, typically within 30 days. This delay in payment improves your cash flow and helps build your business credit score as you make timely payments. This guide will provide an overview of net 30 accounts, explain their benefits, and how they can be used to improve your business credit and cash flow.

We at BCC Supplies specialize in providing businesses with NET30 payment terms on a wide range of products. With our experience in business credit net 30 vendors, we’ve helped countless businesses manage their cash flow and improve their credit standing.

Let’s dive into how net 30 accounts can be a game-changer for your business.

Find more about business credit net 30 vendors:

A net 30 account is a type of trade credit that allows businesses to purchase goods or services and pay the invoice within 30 calendar days. This means if you receive an invoice on the 1st of the month, your payment is due by the 30th. Here’s a breakdown of what you need to know:

Invoice Payment Terms

Net 30 refers to the payment terms on an invoice. When a vendor extends these terms, they expect the full payment within 30 days from the invoice date. This is not to be confused with business days—it’s 30 calendar days. For example, if you receive an invoice on August 1st, you need to pay it by August 31st.

Trade Lines

Trade lines are another term for accounts with vendors that offer net 30 payment terms. These accounts are crucial for managing cash flow and building business credit. When you make timely payments on these trade lines, it shows that your business can handle its financial obligations responsibly.

Deferred Payments

One of the main benefits of net 30 accounts is the ability to defer payments. This means you get the goods or services immediately but have up to 30 days to pay for them. This deferred payment period can be a lifesaver for businesses that need to manage their cash flow carefully.

Business Credit Profile

Your business credit profile benefits significantly from net 30 accounts. Most net 30 vendors report your payment history to major credit bureaus like Dun & Bradstreet, Experian, and Equifax. Timely payments on these accounts can boost your business credit score. A higher business credit score can lead to better loan terms, higher credit limits, and more favorable payment terms from other vendors.

Real-World Example

Imagine a small business that needs to purchase $1,000 worth of office supplies. With a net 30 account, they can get the supplies immediately and have 30 days to generate revenue to pay off the invoice. If they pay on time, this transaction is reported to the credit bureaus, improving their business credit score.

Pro Tip: Always check if the vendor reports to credit bureaus before opening a net 30 account. This ensures your payments contribute to building your business credit.

By understanding and utilizing net 30 accounts, you can improve your cash flow, build your business credit profile, and establish strong trade lines with vendors.

Next, we’ll explore the top net 30 vendors you should consider for your business.

Benefits of Net 30 Accounts for Business Owners

Understanding how net 30 accounts can benefit your business is crucial. Let’s explore the key advantages:

Financial Flexibility

Net 30 accounts provide financial flexibility. By giving you 30 days to pay for goods or services, you can allocate your available cash to other immediate needs. This means you can invest in growth opportunities, pay other bills, or handle unexpected expenses without worrying about running out of money.

For example, a small retail store can stock up on inventory and start selling products before the invoice is due. The revenue from these sales can then be used to pay the supplier’s invoice, creating a smooth cash flow cycle.

Cash Flow Management

One of the biggest benefits of net 30 accounts is improved cash flow management. When you have 30 days to pay your invoices, you can use your available cash for other immediate needs. This allows you to invest in growth opportunities, pay other bills, or handle unexpected expenses without worrying about running out of money.

For instance, Lisa, an e-commerce entrepreneur, struggled with cash flow issues. By opening a net 30 account with her primary supplier, she could purchase materials and pay for them within 30 days. This improved her cash flow, enabling her to reinvest in her business more quickly.

Credit Building

Using net 30 accounts can also help build your business credit. Many vendors report your payment history to business credit bureaus like Dun & Bradstreet and Experian. Paying your invoices on time can positively impact your business credit score.

Tom, who runs a growing wholesale business, used net 30 accounts with multiple suppliers to build his credit. Over time, his positive payment history boosted his business credit score, enabling him to access larger loans with better terms.

Early Payment Discounts

Some suppliers offer early payment discounts as an incentive for paying invoices before the due date. For example, a 1%/10 net 30 term means you get a 1% discount if you pay within 10 days. These discounts can add up over time and lead to significant savings.

For instance, if you receive an invoice for $1,000 and pay within 10 days, you might only need to pay $990, saving $10. Over multiple transactions, these savings can significantly improve your profit margins.

Real-World Benefits

Let’s look at some real-life examples:

- E-commerce Startup: Lisa, an e-commerce entrepreneur, improved her cash flow by using net 30 terms, allowing her to reinvest in her business and increase sales.

- Small Retailer: John used net 30 terms to expand his product line without the immediate financial burden, leading to increased sales and profits.

- Service Provider: Emily, who runs a digital marketing agency, improved her cash flow by aligning her expenses with her revenue cycle using net 30 terms. This stability allowed her to focus on delivering quality services and building stronger client relationships.

- Growing Business: Tom used net 30 accounts to build his business credit, enabling him to access larger loans with better terms for future expansion.

By understanding and utilizing net 30 accounts, you can improve your cash flow, build your business credit profile, and establish strong trade lines with vendors.

Next, we’ll explore the top net 30 vendors you should consider for your business.

Top Net 30 Vendors to Consider

Choosing the right net 30 vendors can make a significant difference in managing your cash flow and building your business credit. Here’s a list of top vendors that offer net 30 terms and are worth considering:

BCC Supplies

BCC Supplies offers a wide array of products, from office supplies to industrial equipment. Their flexible payment terms and competitive pricing make them a top choice for businesses looking to improve cash flow and build credit. Plus, their exceptional customer service ensures a smooth experience.

By choosing the right net 30 vendors, you can improve your cash flow, build your business credit, and ensure your business has the supplies it needs to operate smoothly.

Next, we’ll explore how to apply for a net 30 account.

How to Apply for a Net 30 Account

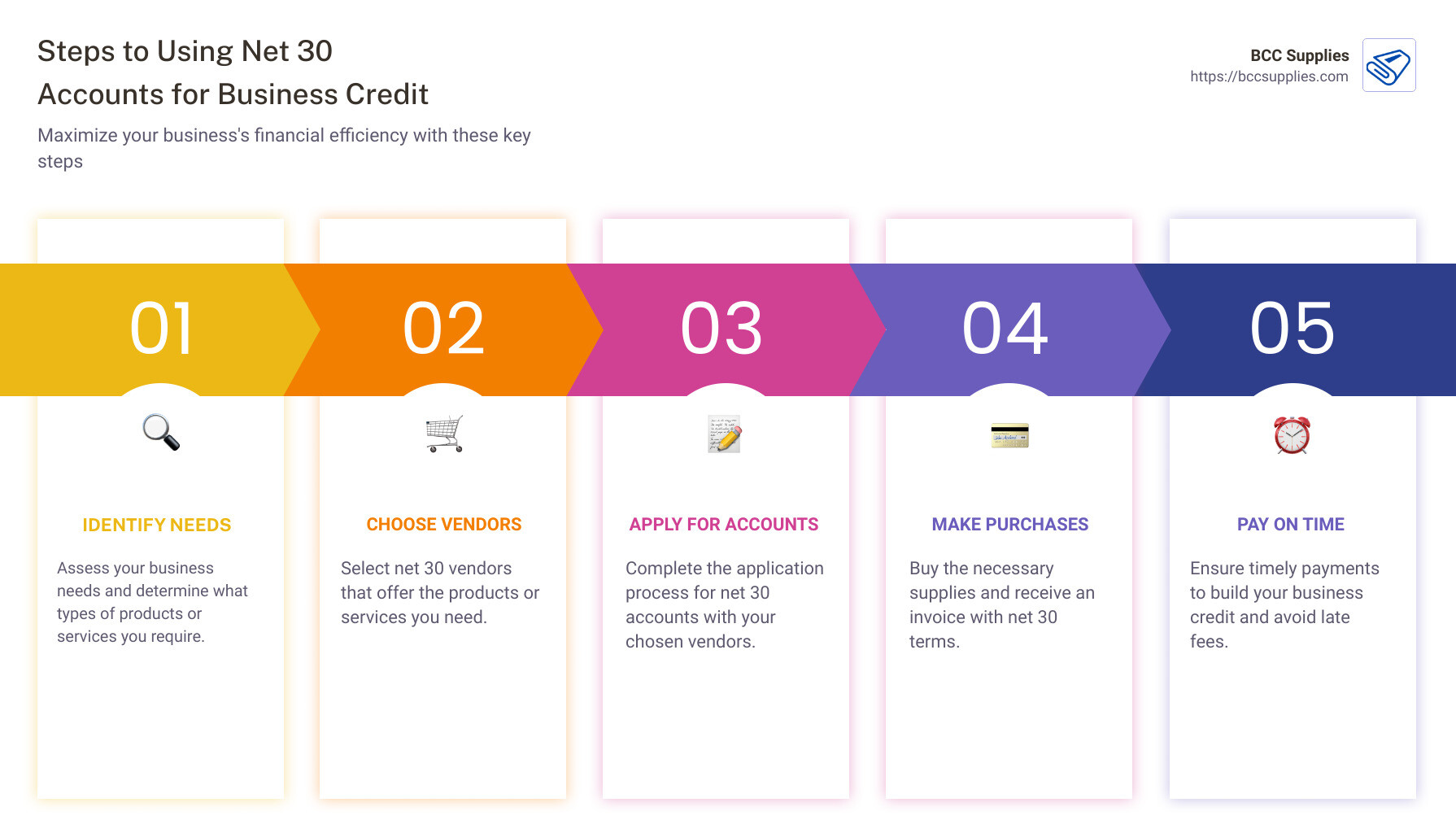

Ready to apply for a net 30 account? Here’s a step-by-step guide to help you through the process:

Application Process

- Choose a Vendor: Start by selecting a vendor that offers net 30 terms and matches your business needs.

- Visit the Vendor’s Website: Look for the “Credit Application” section, usually found in the customer service or account sections.

- Fill Out the Application: Provide accurate and complete information about your business. This usually includes your business name, address, and contact information.

- Submit the Application: Most vendors allow you to submit your application online, but some may require you to email or mail it.

Required Documentation

To apply for a net 30 account, you’ll need to gather some essential documents. These help the vendor verify your business and assess creditworthiness.

- Employer Identification Number (EIN): Issued by the IRS, this number identifies your business for tax purposes.

- Business License: Proof that your business is legally registered and operating.

- D-U-N-S Number: A unique identifier for your business provided by Dun & Bradstreet.

- Business Bank Account: Helps to verify your financial stability.

- Trade References: Some vendors may ask for references from other suppliers to gauge your payment history.

Credit Checks

Not all vendors perform credit checks, but many do. Here’s what you need to know:

- Soft Check: Some vendors perform a soft credit check, which does not affect your credit score.

- Hard Check: Others may perform a hard credit check, which can impact your credit score. Be sure to ask the vendor which type they use.

- Credit Bureaus: Vendors may check your business credit with bureaus like Dun & Bradstreet, Experian, or Equifax.

Approval Criteria

Different vendors have different approval criteria. Here are some common requirements:

- Fundability Foundation™: A solid business structure, including a business bank account and a phone number listed in National 411, can improve your chances of approval.

- Credit Profile: A good credit score with bureaus like Dun & Bradstreet, Experian, or Equifax can be crucial.

- Time in Business: Some vendors require at least two years in business.

- Minimum Purchase: Some vendors require a minimum order value to qualify.

- No Delinquencies: A clean business history with no late payments or derogatory reports is often essential.

By following these steps and meeting the documentation and approval criteria, you can successfully apply for a net 30 account. These accounts will help you manage cash flow, build business credit, and gain financial flexibility.

Next, let’s look at how net 30 accounts impact your business credit.

How Net 30 Accounts Impact Business Credit

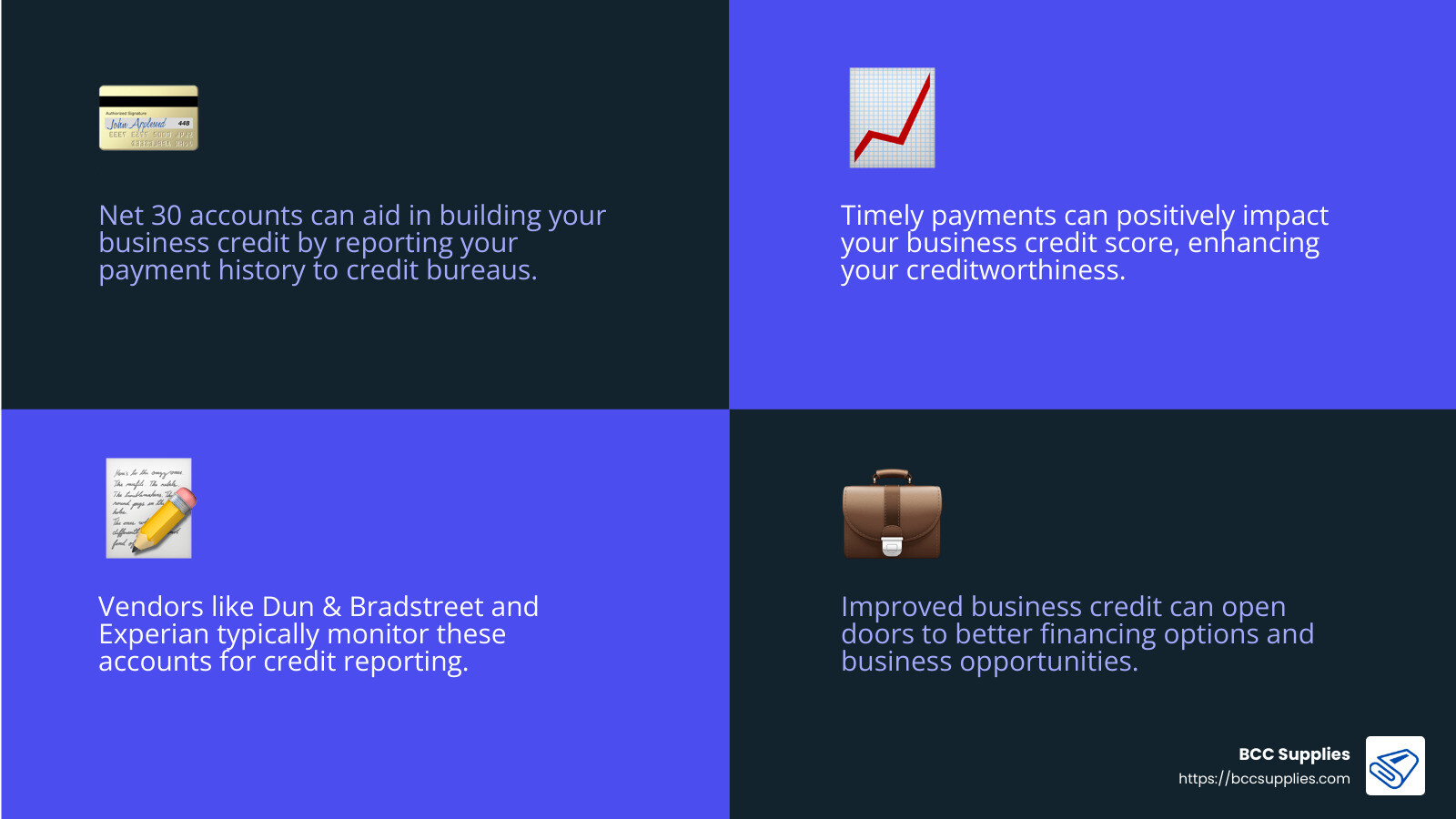

Credit Reporting

When you set up a net 30 account, your payment history is reported to business credit bureaus. This is crucial for building your business credit profile. The main bureaus that track business credit are:

- Dun & Bradstreet

- Experian

- Equifax

Each of these bureaus collects data on your business’s creditworthiness, which includes how promptly you pay your invoices.

Dun & Bradstreet

Dun & Bradstreet (D&B) is a key player in business credit reporting. They assign a D-U-N-S number to your business, which is essential for tracking your credit activity. Your payment history is compiled into a PAYDEX score, ranging from 1 to 100. A score of 80 or higher is considered excellent and indicates that you consistently pay your bills on time or early.

Experian

Experian Business offers the Intelliscore Plus, which ranges from 1 to 100. This score assesses the risk of your business defaulting on payments. A higher score means lower risk. Experian collects data from various sources, including your net 30 vendors, to calculate this score.

Equifax

Equifax Business Risk Scores range from 101 to 992. These scores reflect the likelihood of severe delinquency on any account. Equifax gathers information from your vendors, banks, and other financial institutions to formulate this score.

Payment History

Your payment history is the backbone of your business credit score. Here’s how it works:

- On-Time Payments: Making payments on or before the due date boosts your credit score. For example, if you have a $5,000 invoice due in 30 days and you pay it on time, this positive behavior is reported to the credit bureaus.

- Early Payments: Paying early can also benefit your score. Some businesses even pay before they receive the bill to leverage a higher PAYDEX score.

- Late Payments: Missing a payment deadline can hurt your credit score. Late fees may also apply, further straining your finances. For instance, a vendor might charge a 2% late fee for every month a payment is overdue, which adds up quickly.

Credit Score Improvement

Consistently paying your net 30 accounts on time can lead to significant improvements in your business credit score. This opens doors to:

- Qualifying for Loans: Higher credit scores make it easier to get approved for loans.

- Better Interest Rates: Good credit often leads to lower interest rates on loans and credit lines.

- Investor Attraction: A strong credit profile can attract investors, showcasing your business’s reliability.

By ensuring your positive payment behavior is reported, you can build a robust business credit profile. This makes your business more attractive to lenders, partners, and investors.

Next, we will answer some frequently asked questions about business credit net 30 vendors.

Frequently Asked Questions about Business Credit Net 30 Vendors

Do net 30 accounts build business credit?

Yes, net 30 accounts can significantly build your business credit. When you make payments on time, this positive payment history is reported to major credit bureaus like Dun & Bradstreet, Experian, and Equifax. These bureaus then update your business credit profile, which can improve your credit score over time.

For example, Dun & Bradstreet uses this data to calculate your PAYDEX score, while Experian updates your Intelliscore Plus. A higher score means better creditworthiness, which can help you qualify for loans and get better interest rates.

How many net 30 accounts should I have?

Starting with one or two net 30 accounts is usually a good idea for new businesses. This helps you manage your finances without overwhelming your cash flow. As your business grows and you become more comfortable managing multiple accounts, you can consider expanding.

Having multiple net 30 accounts is beneficial for building business credit. Each account that reports to credit bureaus contributes to your credit profile. The more positive payment histories you have, the stronger your business credit score will be.

What happens if I miss a net 30 payment?

Missing a net 30 payment can have several negative consequences:

Late Fees: Most vendors charge late fees, typically a percentage of the overdue amount. For instance, a vendor might charge a 2% late fee for every month a payment is overdue. This can add up quickly and strain your finances.

Credit Score Impact: Late payments are reported to credit bureaus like Dun & Bradstreet, Experian, and Equifax. This can lower your business credit score, making it harder to qualify for loans or get favorable interest rates in the future.

Vendor Relations: Consistently missing payments can damage your relationship with vendors. They may be less willing to extend credit to you in the future, or they might require stricter payment terms.

In summary, timely payments are crucial for maintaining a good credit score and healthy vendor relationships.

Conclusion

In today’s business world, managing cash flow effectively is crucial for success. BCC Supplies is here to help you achieve that with our net 30 accounts, which allow you to purchase now and pay later, giving you the financial flexibility you need.

By choosing BCC Supplies, you’re not just getting wholesale prices on business essentials; you’re also gaining access to advanced AI tools that can help you streamline operations and grow your business. Whether you need office supplies, industrial equipment, or digital resources like eBooks and business forms, we have you covered.

Our net 30 accounts also help you build and improve your business credit. We report your payment history to major credit bureaus like Moody’s and Experian, and we will soon expand to Dun & Bradstreet and Equifax. This means that timely payments can significantly boost your credit score, making it easier to secure loans and better interest rates in the future.

Moreover, our Executive Lounge Community membership offers exclusive benefits for just $25 a month. This includes a net 30 tradeline account, access to AI tools, and a library of digital resources. Plus, members receive a free eBook and tokens for AI tool usage upon subscription.

Choosing BCC Supplies means opting for a vendor that understands the needs of growing businesses. Our unique net 30 terms, extensive product offerings, and innovative tools provide unparalleled value. Explore our offerings today and experience the difference.

For more information or to get started with a net 30 account, visit our Net 30 Accounts page. Let’s take your business to the next level together.