Everything You Need to Know About Accountancy Practice Management Software

Discover the benefits, features, and top solutions for accountancy practice management software to enhance efficiency and profitability.

How Accountancy Practice Management Software Can Transform Your Firm

Accountancy practice management software is a game-changer for accounting firms, offering essential tools to manage clients, team members, and workflows on a single platform. This software boosts efficiency, collaboration, and accuracy, ultimately elevating the client experience. Here are the key points to understand:

- Increased Efficiency: Automates repetitive tasks like data entry and invoicing, freeing up time for more valuable activities.

- Improved Communication: Provides a secure platform for seamless communication with clients and team members.

- Improved Accuracy: Automates workflows to reduce errors and ensure compliance.

- Better Client Experience: Offers a smooth and secure way to collaborate and share information with clients.

At BCC Supplies, we understand the importance of choosing the right technology for your accounting practice. With over a decade of experience helping businesses streamline their operations with top-quality supplies and cutting-edge tools, we are committed to offering solutions that make a difference. Read on to find how accountancy practice management software can take your firm to the next level.

What is Accountancy Practice Management Software?

Accountancy practice management software provides the tools and features accounting firms need to manage their daily operations efficiently. This software centralizes client communication, document management, task automation, team collaboration, time and billing, and more.

Key Features of Accountancy Practice Management Software

Project and Task Management

- Assign tasks easily: Allocate tasks to team members and track progress.

- Search functionality: Use filters or tags to find tasks quickly.

- Progress tracking: Monitor the overall status of projects and individual tasks.

Team Collaboration

- Onboarding tools: Easily add new or seasonal employees.

- Task assignment: Assign tasks and track progress, especially during busy seasons.

- Communication: Securely communicate with team members to ensure smooth operations.

Workflow Automation

- Automate repetitive tasks: Reduce manual work by automating data entry, report generation, and invoicing.

- Standard operating procedures: Use workflow templates to maintain work quality.

Time Tracking and Billing

- Time-entry screens: Intuitive screens for easy time tracking.

- Billing by project: Manage billing processes and review historical transactions.

- Client A/R balances: Track and manage client accounts receivable.

Client Management

- Organize client information: Store all client details in one place for easy access.

- Secure collaboration: Share documents and information securely with clients.

Reporting

- Performance insights: Identify inefficiencies and bottlenecks with detailed reports.

- Historical records: Maintain visibility into who worked on what and when.

Ease of Use

- User-friendly interface: Save time on implementation and training with intuitive software.

Pricing

- Affordable solutions: Choose software that fits within your budget and scales with your firm.

Purpose of Accountancy Practice Management Software

The primary purpose of accountancy practice management software is to streamline accounting processes, automate workflows, reduce paperwork, and improve client experience. Modern accounting firms use this software to:

- Increase Efficiency: Automate routine tasks, allowing accountants to focus on more valuable activities.

- Improve Collaboration: Provide a secure platform for team communication and client interaction.

- Ensure Accuracy: Automate workflows to minimize errors and ensure compliance.

- Improve Client Experience: Offer a smooth and secure way for clients to collaborate and share information.

By leveraging these tools, accounting firms can manage their operations more effectively, leading to increased productivity and firm growth.

Next, we’ll dig into the benefits of using accountancy practice management software and how it can transform your accounting firm.

Benefits of Using Accountancy Practice Management Software

Using accountancy practice management software can revolutionize your accounting firm by enhancing efficiency, communication, scalability, and profitability. Here’s how:

Improved Efficiency

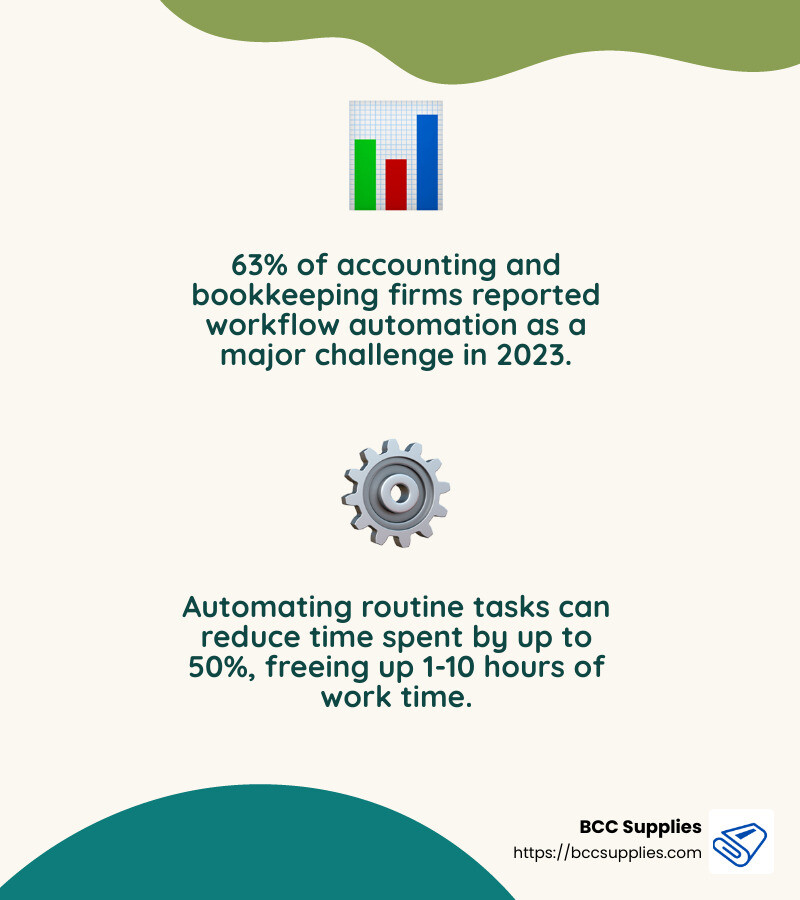

Automating routine tasks such as billing and data entry can significantly cut down on the time spent on manual work. According to a report, automating these tasks can reduce time spent by up to 50%, freeing up 1-10 hours of work time. This allows your team to focus on more strategic activities that add value to your clients.

Improved Data Analysis

With accountancy practice management software, you can turn unstructured information into actionable insights. The software provides detailed reports and dashboards that help you monitor key performance indicators (KPIs) in real-time. Gaining business intelligence into client, process, and billing data allows you to identify inefficiencies and areas for improvement.

Improved Communication

Effective communication is crucial in any accounting firm. A good practice management system includes inbuilt communication features that make it easy for teams to collaborate in real-time. This ensures that important details are not missed, and tasks are completed efficiently. Additionally, the software allows you to securely communicate with clients, enhancing the client experience.

Remote Work Capabilities

With the increasing trend towards remote work, especially post-COVID-19, having a cloud-based practice management software is essential. This software allows your team to manage client tasks and collaborate from anywhere, ensuring business continuity and flexibility. You can track the status of projects, communicate with your team, and store client information securely, all while working remotely.

Increased Scalability

Scaling your accounting firm doesn’t necessarily mean hiring more staff. With the right accountancy practice management software, you can streamline processes, automate workflows, and manage more clients efficiently. This enables your firm to grow without a proportional increase in costs. For instance, 63% of accounting and bookkeeping firms reported that workflow automation was a major challenge, indicating the importance of this feature for scalability.

Improved Profitability

By improving efficiency and reducing the time spent on manual tasks, your firm can take on more clients and optimize other operational aspects. This leads to increased revenue and improved profitability. Automating billing and time tracking ensures accurate invoices, faster payments, and better management of accounts receivable, further contributing to your bottom line.

Next, we’ll explore the 8 essential features to look for in accountancy practice management software to ensure you choose the best solution for your firm.

8 Essential Features of Accountancy Practice Management Software

Choosing the right accountancy practice management software is crucial for maximizing your firm’s efficiency and growth. Here are the eight essential features to look for:

1. Project Management

Effective project management is key. Your software should help you:

- Assign tasks to team members easily.

- Track the progress of tasks and projects.

- Use filters or tags to simplify task searching.

Questions to consider: Are projects being completed on time? Is your workflow efficient?

2. Team Collaboration

Smooth collaboration ensures nothing falls through the cracks. Look for features that:

- Facilitate real-time communication.

- Allow onboarding of new or seasonal employees.

- Enable task assignment with different access rights.

During busy seasons, like tax time, these features are invaluable.

3. Workflow Automation

Automation saves time and reduces errors. Essential automation features include:

- Creating task dependencies.

- Sending automatic reminders to clients.

- Automating repetitive tasks.

In 2023, 63% of accounting firms reported workflow as a major challenge, highlighting the need for robust automation.

4. Time Tracking and Billing

Accurate time tracking is vital for billing. Your software should:

- Track time spent on each project.

- Record expenses.

- Auto-generate invoices based on tracked data.

This ensures you get paid accurately and promptly.

5. Client Management

A good client management system includes:

- A secure client portal for document sharing and communication.

- Tools to manage client information and interactions.

- Features for requesting e-signatures and managing access rights.

Happy clients keep coming back, and a client portal improves their experience.

6. Reporting

Insightful reporting helps you make informed decisions. Look for:

- Pre-built report templates.

- Customizable reporting options.

- Reports that cover key performance indicators (KPIs).

Understanding your data helps you identify areas for improvement and track your firm’s performance.

7. Ease of Use

The software should be user-friendly. Consider:

- How intuitive the interface is.

- The learning curve for your team.

- Availability of training and support.

A user-friendly system ensures quick adoption and efficient use.

8. Pricing

Pricing can vary widely. Consider:

- Your budget and the software’s cost.

- Whether you prefer monthly or annual payments.

- The value provided by the software relative to its price.

Some platforms offer significant savings with annual subscriptions, so evaluate all options.

Next, we’ll dive into the top 5 accountancy practice management software solutions in 2024 to help you make an informed choice.

How to Choose the Right Accountancy Practice Management Software

Choosing the right accountancy practice management software can feel overwhelming, but it doesn’t have to be. Here’s a simple guide to help you make the best choice for your firm.

Firm Size

Your firm’s size is a key factor. Small firms (1-10 employees) might prioritize ease of use and affordability, while larger firms (50+ employees) need robust features for team collaboration and project management.

Specific Needs

Identify your firm’s specific needs. Do you need advanced reporting? Time tracking? Client management? Make a list of must-have features.

Budget

Budget is always important. Look at both the upfront costs and any recurring fees.

Scalability

Think about the future. Your firm might grow, and your software should grow with you. Look for solutions that offer scalability.

User Reviews

User reviews provide real-world insights. Check platforms like Capterra or G2 for reviews. Look for comments on ease of use, customer support, and any potential issues.

Conduct Demos

Finally, always conduct demos. Most providers offer free trials or live demos. Use this time to ask specific questions about functionalities you care about, like task management, client portals, or billing. This hands-on experience will help you see if the software meets your needs.

By considering these factors, you can choose the right accountancy practice management software that fits your firm’s unique requirements.

Frequently Asked Questions about Accountancy Practice Management Software

What is the best practice management software for accountants?

Choosing the best accountancy practice management software depends on your firm’s needs. Consider factors like ease of use, integration capabilities, and specific features such as project management and client portals.

How much does accountancy practice management software cost?

The cost of accountancy practice management software varies widely based on features and the number of users. Most software uses a subscription model, charging monthly or annually.

What are the key features to look for in accountancy practice management software?

When selecting accountancy practice management software, look for features that support project management, team collaboration, workflow automation, time tracking, client management, reporting, ease of use, and pricing that fits your budget.

By focusing on these features, you can find the right accountancy practice management software to meet your firm’s needs.

Conclusion

In summary, accountancy practice management software is a game-changer for accounting firms of all sizes. It streamlines processes, improves team collaboration, and enhances client management. By integrating project management, workflow automation, and robust reporting, these tools help firms operate more efficiently and profitably.

At BCC Supplies, we understand the importance of having the right tools to manage your accounting practice effectively. Our platform offers a range of business supplies and advanced AI tools designed to boost productivity and support your growth. We provide competitive pricing, ensuring you get the best value for your investment.

Choosing the right accountancy practice management software is crucial for your firm’s success. Consider your specific needs, budget, and the features that matter most to you. With the right software, you can take your accounting practice to new heights, ensuring better client satisfaction and streamlined operations.

For more insights and tools to improve your business productivity, explore our business supplies and essentials.

By leveraging the right software and resources, you can ensure your firm stays ahead of the curve, providing top-notch service to your clients and driving growth efficiently.