An Essential Guide to Net 30 Business Credit Card Options

Discover the benefits and top options of net30 credit card for business credit and cash flow flexibility. Learn how to apply today!

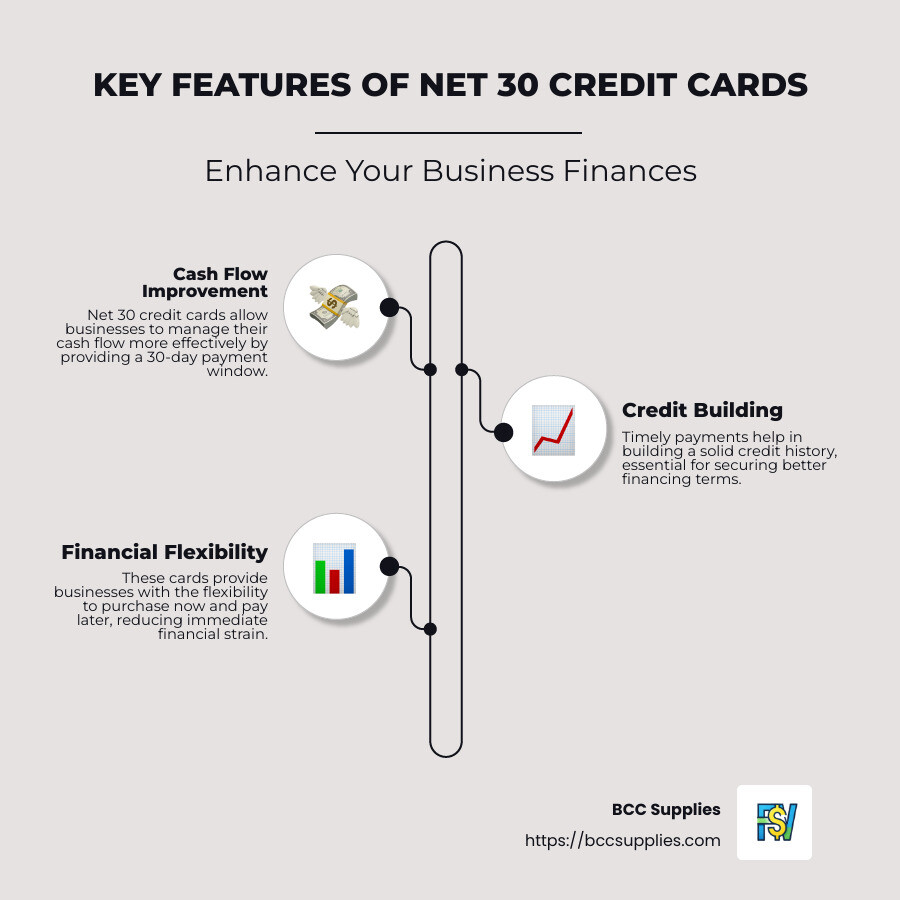

A net30 credit card can be a game changer for small business owners. It offers the opportunity to improve cash flow by allowing businesses to purchase now and pay later, typically within 30 days. This is often referred to as trade credit and helps businesses build a solid credit history, which is essential for securing better financing terms and future growth.

- Net 30 Accounts: Purchase goods/services now and pay in 30 days.

- Trade Credit: Boost cash flow and manage expenses efficiently.

- Business Credit: Build credit history with timely payments.

For small business owners striving to remain competitive, understanding how net30 credit card options function is crucial. These cards allow entrepreneurs to manage finances more effectively, reduce upfront costs, and establish favorable credit terms by using vendor and supplier accounts. By responsibly utilizing these accounts, businesses not only improve their credit profiles but also open doors to more extensive financing opportunities.

At BCC Supplies, we specialize in providing net30 credit card options. Our experience in offering a broad range of products and easy approval processes makes it easier for businesses to get the resources they need. Transitioning into the following sections will reveal how you can benefit from these accounts.

Find more about net30 credit card:

Understanding Net 30 Credit Cards

A net30 credit card is a unique financial tool designed for businesses. It allows companies to buy goods or services and pay the invoice within 30 days. This setup, known as trade credit, is crucial for managing cash flow and building a strong business credit profile.

Payment Terms and Trade Lines

Payment terms for net30 credit cards are straightforward. Once you make a purchase, you have 30 calendar days to settle the bill. This period helps businesses manage their finances without the pressure of immediate payment. These are calendar days, not business days, so weekends and holidays are included.

A trade line is any credit line that appears on your business credit report. When you use a net30 credit card, every transaction and payment you make can be reported as a trade line. This is beneficial because:

- Trade lines contribute to your business credit score. Each timely payment strengthens your credit profile.

- The more positive trade lines you have, the better your business looks to potential lenders and vendors.

Why Choose a Net30 Credit Card?

Opting for a net30 credit card offers several advantages:

- Improved cash flow: You can purchase what you need now and pay later, freeing up cash for other business needs.

- Credit building: Regular, on-time payments help build your business credit, which is essential for future financing.

- No interest charges: As long as you pay within the 30-day period, you avoid interest fees, unlike traditional credit cards.

By leveraging these benefits, businesses can not only manage their finances better but also position themselves for growth. As you explore further, you’ll find how BCC Supplies and other providers can offer custom net30 credit card solutions to suit your business needs.

Benefits of Net 30 Credit Cards

Let’s explore why a net30 credit card can be a game-changer for your business. These cards are more than just a payment tool—they’re a strategic asset for managing cash flow, building credit, and enhancing financial flexibility.

Cash Flow Management

One of the biggest perks of using a net30 credit card is the boost it gives to cash flow management. Imagine buying the supplies you need today but not having to pay for them until 30 days later. This delay allows you to use your cash for other immediate needs, like paying employees or investing in new opportunities.

For example, a small retail store can stock up on inventory, start selling products, and use the revenue to pay off the invoice. This creates a smooth cash flow cycle that keeps the business running efficiently.

Credit Building

Building business credit is crucial, and net30 credit cards make it easier. Many vendors report your payment history to business credit bureaus. Each on-time payment strengthens your credit profile, making it easier to secure loans and negotiate better terms with suppliers.

Consider a business owner who used net30 accounts with multiple suppliers. By ensuring all payments were made promptly, they significantly boosted their business credit score. This improvement allowed access to larger loans with better terms, fueling business growth.

Financial Flexibility

Net30 credit cards offer financial flexibility by giving you more time to pay for goods and services. This is especially helpful during seasonal revenue fluctuations or when unexpected expenses arise. For instance, a construction company can purchase materials on credit, complete a project, and get paid before the supplier’s invoice is due. This deferred payment option helps businesses operate smoothly without needing large upfront capital.

Moreover, some suppliers offer early payment discounts, such as a 1% discount if you pay within 10 days. Taking advantage of these discounts can lead to significant savings over time, reducing overall expenses and improving profit margins.

In summary, the benefits of a net30 credit card—from improved cash flow to improved credit building and financial flexibility—make it an invaluable tool for any business aiming to strengthen its financial health.

Top Net 30 Credit Card Options

When it comes to choosing a net30 credit card, it’s crucial to find options that align with your business needs. Here are some top choices that offer easy approval, valuable vendor accounts, and reliable credit reporting:

BCC Supplies

BCC Supplies stands out as a versatile option for businesses seeking office supplies and essential products. With a focus on providing easy approval for net30 accounts, BCC Supplies makes it straightforward for businesses to manage their purchases. They offer a wide range of office essentials that cater to various business needs, ensuring that companies can maintain smooth operations without financial strain.

Digital Solutions Hub

For businesses in need of digital marketing and consulting services, Digital Solutions Hub offers net30 credit card options custom to these sectors. This vendor provides essential tools for online growth and brand development, making it a valuable partner for businesses looking to improve their digital presence. The ease of approval and robust credit reporting ensure that businesses can build their credit profiles while accessing top-notch services.

Office Essentials Direct

Office Essentials Direct is perfect for businesses requiring a steady supply of office and teaching supplies. Their net30 accounts offer flexibility and convenience, allowing companies to acquire necessary products without immediate payment. This setup is particularly beneficial for educational institutions or businesses with regular supply needs. By reporting to major credit bureaus, Office Essentials Direct helps businesses strengthen their credit history.

Industrial Tools Network

For businesses in the industrial sector, Industrial Tools Network provides net30 credit card options that cover a wide range of industrial supplies and safety equipment. This vendor is ideal for companies that need reliable tools and safety gear to maintain operational efficiency. With easy approval processes and comprehensive credit reporting, businesses can manage their operational costs while building a solid credit foundation.

Mail Order Office Supplies

Mail Order Office Supplies caters to businesses preferring the convenience of mail-order shopping for office products. Their net30 accounts offer an easy approval process, making it simple for businesses to access a wide array of office supplies. This option is especially beneficial for remote or home-based businesses that rely on mail-order services. The vendor’s commitment to credit reporting ensures that businesses can improve their credit scores through consistent, timely payments.

These vendors provide diverse options for businesses looking to leverage the benefits of a net30 credit card. By choosing the right vendor, businesses can enjoy improved cash flow, improved credit profiles, and the flexibility to grow and adapt in a competitive market.

How to Apply for a Net 30 Credit Card

Applying for a net30 credit card can seem daunting, but it’s a straightforward process if you know what to expect. This section will guide you through the application process, credit checks, and business requirements.

Application Process

Choose a Vendor: Start by selecting a vendor that offers net30 terms and aligns with your business needs. For example, BCC Supplies is a great option for office essentials.

Visit the Vendor’s Website: Most vendors have an online application form. Look for the “Credit Application” section to begin.

Fill Out the Application: Provide accurate and complete information about your business. This typically includes your business name, address, and contact details.

Submit the Application: You can usually submit your application online. Some vendors might also accept applications via email or phone.

Follow Up: After submitting, follow up with the vendor to ensure your application is being processed. A quick email or call can keep your application on their radar.

Credit Check

Vendors offering net30 credit cards may perform a credit check to assess your business’s creditworthiness. Here’s what they typically look for:

Business Credit Score: A good credit score can improve your chances of approval. Vendors might require a PAYDEX score of 80 or higher.

Credit History: Vendors will review your business’s payment history. Timely payments on existing accounts can boost your profile.

Personal Credit Check: Some vendors might check personal credit, especially for newer businesses. Ensure your personal credit is in good standing to avoid any problems.

Business Requirements

Before applying, ensure your business meets the necessary requirements:

EIN and Business License: Most vendors require an Employer Identification Number (EIN) and a valid business license to verify your business’s legitimacy.

D-U-N-S Number: This unique identifier from Dun & Bradstreet is often required to establish your business’s credit profile.

Business Bank Account: Having a business bank account can demonstrate financial stability and is often a requirement.

Trade References: Some vendors may ask for trade references to assess your payment history with other suppliers.

By understanding these steps and requirements, you can successfully apply for a net30 credit card, enhancing your business’s financial flexibility and credit profile.

Up next, we’ll tackle some frequently asked questions about net30 credit cards to further clarify any doubts you might have.

Frequently Asked Questions about Net 30 Credit Cards

What is a net 30 credit card?

A net30 credit card is a trade credit tool that allows businesses to purchase goods or services and pay the invoice within 30 days. Unlike traditional credit cards, these cards focus on enhancing business cash flow by providing a 30-day payment period without interest charges if paid on time. This means businesses have the flexibility to manage their cash flow while awaiting incoming revenue.

Does applying for net 30 affect credit score?

Applying for a net30 credit card can impact your business credit score, but it depends on whether the vendor reports to credit bureaus. If they do, timely payments can positively influence your business credit history. For example, some vendors report to major credit bureaus such as Equifax, which can help build a positive credit profile over time. However, some vendors might perform a personal credit check during the application process, which could temporarily affect your personal credit score.

Are there fees associated with net 30 accounts?

Net 30 accounts typically do not have annual fees or interest charges if the invoice is paid within the 30-day period. However, if payments are late, vendors may impose late fees, which are often a percentage of the overdue balance. For instance, a 1.5% monthly late fee could quickly add up and harm your business credit score if not managed properly. Always check the vendor’s terms to understand any potential fees associated with late payments.

By understanding these aspects, businesses can make informed decisions when considering a net30 credit card, ensuring they optimize their financial operations and maintain a healthy credit profile.

Conclusion

In the evolving world of business finance, utilizing tools like net 30 credit cards can be crucial for growth. At BCC Supplies, we are dedicated to empowering businesses with the resources they need to succeed. Our platform offers competitive pricing on essential business supplies and integrates advanced AI tools designed to enhance productivity and drive growth.

Using a net30 credit card through BCC Supplies can significantly improve your cash flow management. By taking advantage of the 30-day payment terms, businesses can better align their expenses with incoming revenue, avoiding the pitfalls of cash shortages. This financial flexibility allows you to invest in other areas of your business, fostering growth and innovation.

Moreover, our AI tools provide insights and automation that streamline operations, helping businesses make data-driven decisions. Whether you’re looking to optimize inventory, manage expenses, or improve customer engagement, our digital solutions are tailored to meet your unique needs.

Explore our Net 30 Accounts to see how BCC Supplies can support your business journey. With our commitment to unbeatable prices and cutting-edge technology, we’re here to help you achieve your business goals.

In conclusion, choosing the right financial tools and partners can make all the difference. At BCC Supplies, we’re dedicated to being that partner for you, providing the support and resources necessary for your business to thrive.